Inadequate forecasting is one of the biggest causes of inefficiency in finished vehicle logistics. Victoria Johns finds out how ECG’s Project Caesar is setting the standard for supply chain planning

When ECG published its Efficiency Survey in 2013, the greatest cause of inefficiency in the vehicle logistics sector was found to be unbalanced flows and unequal mileage caused by inaccurate forecasting.

“Some OEM forecasts are at times not satisfactory and lacking completeness, causing a misalignment between capacity and demand. This is turn creates inefficient fleet utilisation, capacity shortfalls and associated hidden costs for OEMs and LSPs alike,” explains ECG executive director, Mike Sturgeon.

Then, at its 2016 industry meeting, ECG along with vehicle-makers and logistics service providers, identified capacity as an area that needed to be improved and set up a working group. “Certainly in 2016 when we were having this conversation, capacity was tight in the sector,” says Sturgeon. “After the financial crisis in 2008 we had seen all the spare capacity in the sector disappear. Volumes were growing again and this was an issue across most of Europe. Poor forecasting was eating into that.”

Sturgeon suggests that as a result of the crisis any spare capacity that was not being used every day was stripped out. “We’ve seen much more caution since then and people haven’t replaced capacity unless it was fully required,” he says.

“If the customer says they need 15 trucks and the LSP sends them, but there are only enough cars for ten, he has five trucks in the wrong place that cannot earn revenue that day because they’ve nothing to carry. That incurs significant wasted cost and resource, which can never be recovered.”

Sturgeon says another capacity concern is congestion at ports, citing a recent example from Zeebrugge in Belgium. “Due to a public holiday in Zeebrugge, there were 70 load lanes on one side of the port,” he says. “By 9am there were more than 200 trucks resulting in massive queues, wasting driving time.”

“Any efficiency problems like that will inevitably be reflected in the costs the customer is paying,” says Sturgeon. “The transportation of new vehicles requires expensive and specialised assets such as road transporters or dedicated rail wagons, which normally cannot be re-purposed for other forms of cargo. It’s very clear that it’s in everyone’s interests to have forecasts that are as accurate as possible so that capacity can be closely matched to demand.”

Tools of the trade

In 2017, ECG’s capacity working group approved what it calls Project Caesar, aimed at improving industry forecasts by introducing a ‘toolbox’ of good practices. The group consists of approximately 40 members. It is co-chaired by Christian Lang from DB Cargo Logistics and Manuel Medina from Seat, representing the Volkswagen Group.

”After the financial crisis in 2008 we had seen all the spare capacity in the sector disappear. Volumes were growing again and this was an issue across most of Europe. Poor forecasting was eating into that” - Mike Sturgeon, ECG

In the first phase of the project, an interview-based survey was created to establish current practice in delivery forecasting within the industry and to identify good practices. Six OEMs and LSPs were interviewed during 2017 and early 2018 to analyse the accuracy and quality of planning information and processes in the finished vehicle supply chain.

From October 2018 until April 2019, pilots were carried out on a one-to-one basis between LSPs and OEMs to test and validate the developed toolbox in order to create an ECG-recommended standard for vehicle logistics on validated good practice.

“We interviewed OEMs and LSPs on current typical delivery forecasting processes, methods and effectiveness. This included in-depth discussions on identified good practices,” explains Ben Waller, associate director at ICDP, which lead the research area of the project and was supported by Stetter Consulting in Germany.

The study included an examination of delivery forecasting in a number of contexts, from factory to market, deep-sea import to market, and factory, deep-sea and market to dealer.

Mind the gap

“Overall, the research confirmed significant gaps in the quality of the typical new vehicle delivery forecasting cycle,” says Waller.

“As we expected, Project Caesar confirmed that the quality of forecasting coming out from the OEMs ranges from very good to not very good. There was no standard methodology behind it,” adds Sturgeon.

“Market to dealer delivery demonstrated the largest variance and problems associated with late changes,” explains Waller. “Factory and deep sea to market planning information was generally found to be more stable, but even for these delivery chains, weekly variance from the weekly detail within forecasts that were provided in previous months was typically around 50%.”

There was a particular shortfall in forward communication associated with market-level actions to achieve wholesale, registration and sales targets.

According to Waller, the forecasting cycle was deficient in many cases due to a lack of internal communication within the OEM, and lack of regularised communication between OEM and LSP. “Whilst some LSPs were provided [with] no forecast at all from some OEMs for some routes, many of the forecasts that were provided by OEMS to LSPs were in fact sales forecasts rather than vehicle delivery forecasts,” he said.

“The overall opportunity for improvement in delivery forecasting was clear, given the gap between typical and best identified variances, and better variances that were supported by a more consistent and better resourced forecasting cycle.”

”Factory and deep sea to market planning information was generally found to be more stable, but even for these delivery chains, weekly variance from the weekly detail within forecasts that were provided in previous months was typically around 50%” - Ben Waller, ICDP

Good practice

Project Caesar identified good practices as being the use of registration and wholesale targets, known lead times and capacities, and detailed analysis of historical activity by OEMs, to create detailed delivery forecasts.

“These delivery forecasts were made by expert resource within the OEM, responsible for the delivery of this detailed forecast and plan to the LSPs. In one case, the OEM sales function at the national market level signed off the delivery forecasts made by an expert group within the OEM, based on the information and insight provided by the sales team,” says Waller.

“Where the sales function disagreed with the delivery forecast because of changes to new car sales planning, a new sales forecast was provided to allow for new planning. Enough time [should be] allowed for that planning, so that the delivery forecasting function could provide the revised forecast and plan to the LSP for their confirmation. All of these activities and associated discussions were diarised within a regular monthly cycle.”

According to Waller, a key prerequisite was a commitment from the OEM, including from both production planning and sales planning, to support vehicle delivery forecasting and planning as a dedicated function within the OEM. Also important was commitment from the OEM and LSP to a stable, regular new vehicle delivery forecasting, planning and review cycle, built around the typical OEM sales and production monthly programming cycle.

Next steps

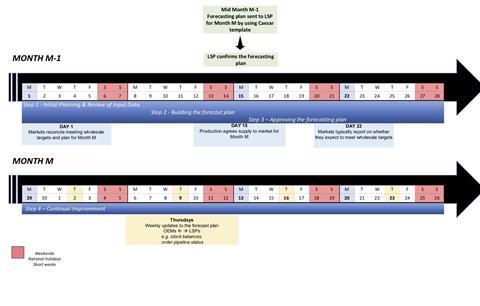

As a result of the pilots, Project Caesar recommends a four-step monthly communication process, which can be implemented by OEMs and LSPs regardless of the mode of transport and which provides a format for the exchange of information and forecast data.

The monthly process begins with an initial planning and sales review within the OEM where sales and production internally co-ordinate and assess the current sales and production forecasts.

In the second step, the setting up of the forecasting plan starts with a specific set of input data, which depends on the nature of the movement of the finished vehicles and a review of that data by the OEM. The third step sees the finalisation of the forecasting plan within the OEM and the confirmation of capacity by the LSP.

The final step of the monthly process introduces the principle of continuous improvement, which should be applied within the forecasting processes between OEMs and LSPs.

Promoting the project

Project Caesar was officially launched at ECG’s Spring Congress in Sorrento in May, but some of its pilot projects are still ongoing.

“The pilots validated the proposed methodology. Now we recommend it and promote it as ECG, expecting our members to also promote it directly with their customers,” states Sturgeon. He says a number of companies are already working in a way similar to Project’s Caesar’s methodology.

“Our members won’t bother trying to push our customers who are already good at forecasting. They know who is accurately forecasting and who is not, so they can encourage the ones who are less good to follow this methodology.

“The issue for us is to get some of the ones who are not so good at forecasting to change and to work in this type of way to improve their methodology,” says Sturgeon. He adds that premium manufacturers have an advantage because a much higher percentage of the product they are making is being built to order.

50%

Typical weekly variance within OEM forecasts for factory and deep sea to market delivery chains, according to ECG research

“Of course, it’s much easier to forecast when you’re building to order than it is when the majority of your product is just being built for stock or pipeline. You can’t lump everyone in together; each OEM has their own way of working.”

“When I worked for an OEM, we put a lot of effort into generating forecasts, but I was aware of other car manufacturers, one in particular, that would just issue their sales forecast and say ‘that’s our forecast’ even though they weren’t building enough cars to hit that forecast – that’s one of the worst examples that I’ve experienced.”

ECG stresses that its published standard is merely a starting point; it will be further improved as best practices are shared. Software may also be developed to support information sharing and the forecasting process. “Project Caesar is not the end, it is just the beginning,” says Sturgeon.

“ECG urges the industry as a whole to adopt this standard. Better use of capacity and resources must be a priority for the sector in order to tackle this long-standing issue. Better forecasting will benefit everyone. In summary, what we want to do with Project Caesar is encourage some of the OEMs and LSPs who are less good to improve, and if we do that, we will have achieved our objective.”

Case study: Mazda and Mosolf

Japanese carmaker Mazda and German LSP Mosolf were both involved in Project Caesar. “Initially we were asked by Mosolf to participate in the project as they consider Mazda Motor Logistics Europe to be one of the benchmarks when it comes to forecasting in the automotive industry” says Geert Rossaert, manager of Mazda Vehicle Logistics Administration Antwerp. “We have invested a lot of resources into system processes and data-driven planning as there is still a lot of efficiency to gain by improving the industry’s forecasting.”

According to Rossaert, the OEM has been able to hit all targets month by month in terms of on time delivery, wholesale targets and retail targets, since becoming involved with the project. Both Mazda and Mosolf are convinced that the use of such a standardised process supports real improvements in delivery performance.

“As an LSP, we are convinced that a well-managed forecasting process is the key enabler to achieve even challenging targets,” says Jorg Lenz, Mosolf’s head of order management. “However, and as studies also show, there is still significant potential for improvement of forecasting, comparing the typical high variances from forecasts to the best practices available in the industry.”

“From the pilot, we learned that good practice in forecasting and planning is about the process itself and the people. It needs a well-structured continuous standard, mutual understanding and common steering processes. And as a matter of course, it needs teamwork and communication to manage expectations and reach all volume, lead time and priority targets.”

Lenz agrees that the new industry standard is “just the beginning”, stating that it is now up to the contribution of each OEM and LSP to implement and develop the standards to finally create real efficiencies.

Rossaert states that the biggest barrier to introducing a standardised forecasting cycle has been the difficulty of securing resources and time within the company.

“We found the experience very positive [but] it is not sufficient to have only a few companies using this forecasting process, it has to become the standard within the automotive industry in order to create some real efficiencies for everybody,” he emphasises.

A good example of this is the introduction of the worldwide harmonised light vehicle procedure test (WLTP) in September 2018. “Despite the fact that our forecasts were correct, we still suffered in terms of lack of terminal space from the fact that in July and August a lot of [other] production was pushed into the market without decent forecasting,” states Rossaert. “That’s why we think the publication and introduction of this forecasting process is only the starting point and we need to get onboard as many companies as possible.”

Regarding WLTP, Sturgeon reports that OEMs have said this year will be easier than last, but that 2020 will have a “significant impact”. ECG is currently producing a revised briefing paper on the effects of the test procedures, which will be launched at its Berlin conference in October.

No comments yet