The surge in US vehicle sales caused by US trade policy on vehicle imports has subsided while behind-the-scences discussions continue between US policy makers and leading vehicle makers seeking a remedy to the 25% levy.

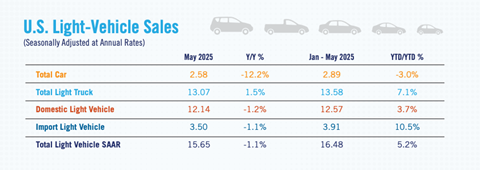

The North American Dealers Association (Nada) reports that the surge in new light-vehicle sales in the US brought about by impending US tariffs on vehicle imports now looks to have subsided. Figures for May this year show that vehicle sales slowed to a 15.7m-unit seasonally adjusted annual rate (Saar) following two months where sales hit a rate of 17m units as consumers pulled ahead purchases to avoid tariff-related price impacts.

An additional 149,000 vehicles were purchased in March and April 2025 according to figures from JD Power, referenced by Nada. The association said it expects the pull-ahead purchases to result in lower monthly sales later in the year.

Almost half of all vehicles sold in the US are imported. GM, Toyota and Mazda are the top three carmakers by volume importing to the US.

Following Trump’s announcement of a 25% tariff on all vehicles imported to the US, which went into effect on April 3, there have been behind-the-scenes negotiations with several carmakers.

Read our timeline of US tariff policy and its impacts on the automotive industry

Tariff cost impact

Vehicle production has fallen slightly in the months following the vehicle tariff announcements, according to the report from Nada. The production cut back, combined by strong sales in March and April, represented the first year-over-year decline in new-vehicle inventory since June 2022.

Nada said that at the start of May 2025, the number of new light-duty vehicles on the ground and in transit to dealer lots was 2.62m units, a decline of 4.1% year over year. The association’s chief economist Patrick Manzi said: “In the coming months, we expect all OEMs to be affected by the tariffs on imported vehicles and parts, although the cost impacts will be much greater for some OEMs than others.”

Manzi said that each OEM has been taking its own strategy when dealing with the cost increases but it is a burden shared with the dealers and end consumers. “Exactly how much each OEM will be affected remains to be seen as the higher costs work their way through the vehicle supply chain,” said Manzi.

Toyota is expected to take the biggest hit. Even though it makes half of the vehicles its sells in the US locally, it still imports 1.2m vehicles a year. This week the carmaker proposed selling US-made vehicles through its own distribution channels in Japan to help narrow the US trade deficit.

Japan’s chief tariff negotiator Ryosei Akazawa is expected in the US this week for a sixth round of talks aimed at securing concessions over a range of tariffs.

This week GM has said it will invest $4 billion in three US plants over the next two years to increase local production and move it out of Mexico. The Orion, Fairfax and Spring Hill Manufacturing plants are all to receive investment.

Additionally, in an interview with Sueddeutsche Zeitung newspaper published on May 30 Volkswagen’s CEO Oliver Blume said the carmaker was in “fair and constructive” talks with the Trump administration over import tariffs and was looking at further large-scale investment in US carmaking.

No comments yet