Class 1 rail providers are responding to demands on capacity by working collaboratively and investing in technology and infrastructure for a more sustainable vehicle deliver network in North America, writes Marcus Williams

Capacity constraints are affecting every mode of finished vehicle transport and the rail network in North America is no different.

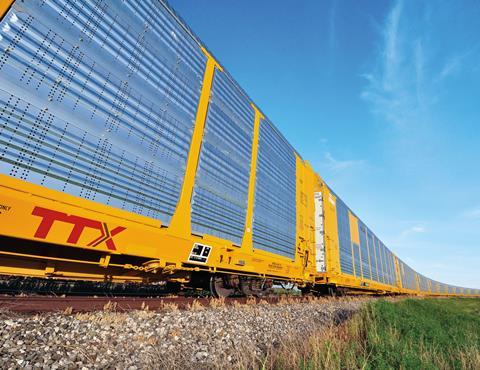

Last year the shortage of finished vehicle logistics capacity on rail services had some carmakers thinking they were dealing with the a ‘new chip crisis’. There are currently around 68,000 auto railcars operative in North America but further investment is needed and there continues to be an unequal allocation of bilevel or trilevel railcars across the North American network.

That existing fleet has been in heavy demand. Last year carmakers were consolidating Asian shipments to the US west coast rather than sailing through the congested Panama Canal to speed up vessel return times because of the shortage in ocean ro-ro capacity. That left OEMs relying on the North American railways to create a so-called land bridge to move eastbound volumes across country. This increase in demand for railcars is putting pressure on railways to return equipment to ports in time for shipments. The network is further complicated by rising local production as well as cross-border vehicle import and export activity and for overseas shipments.

Labour shortages across the rail freight sector is another factor leading to delay, though the situation is gradually improving. According to the Association of American Railroads (AAR) since bottoming out in January 2022, total Class I rail employment as of March 2024 is up 10%, and train and engine employment is up 16%. Today, rail employment is at or above where it was immediately prior to onset of the pandemic, says the AAR.

In response to these challenges, rail providers are looking at mergers and acquisitions, investing in infrastructure and digital technology, and collaborating on efficiency gains and network design, including with providers of road freight services.

Transnational reach

The merger of Canadian Pacific of Kansas City Southern to form CPKC last year created the first transnational railway connecting Canada, the US and Mexico, operating approximately 32,200km (20,000 miles) of rail, employing close to 20,000 people.

Having an integrated single line network is something that is particularly important for the movement of finished vehicles in North America given the reduction in hand-off points between carriers which brings improvements in terms of service and cost, and reduces the risk of damage to the vehicles. A more connected North American rail service answers the needs of an automotive industry that is nearshoring manufacturing and supply in response to a number of factors, including risk management post-pandemic, international trade tensions, geopolitical disruption, and the trade benefits regionally of the United States–Mexico–Canada Agreement (USMCA).

“We connect the entire continent, including a vast network in Mexico, and our network is ideal for growing as we service the trade-dependent economy,” says CPKC’s head of communications, Terry Cunha. “North American automotive manufacturers are looking to better control their supply chains to address the disruptions experienced over the past few years.”

CPKC is in the process of investing more than $275m in new infrastructure to improve rail safety and the capacity between Chicago, Illinois and Laredo, Texas. That is in line with investment plans worth $2.75 billion annually over the next five years. The railroad has identified additional capacity projects in Mexico and the second span of the international bridge at Laredo. CPKC has also made investments in auto racks and in a new auto compound in Dallas/Wylie Texas opening this summer.

The company says it is helping to move finished vehicles more efficiently in response to demands for rail shipment of vehicles between the US west coast ports, and mid-west and eastern delivery points.

In 2021 the company committed an investment of $65.9m in the development of track infrastructure for moving finished vehicles out of the port of Saint John on the east coast of Canada –the first time in 25 years that the rail company served an Atlantic Ocean port for finished vehicle shipments.

On the Pacific side, it provides a route from Vancouver to Chicago that affords the shortest transit time for OEM customers to get vehicles to market.

In Lázaro Cárdenas, meanwhile, CPKC has access to two container terminals operated by companies that are investing heavily in capacity. It is also provides access to port complexes in the Gulf of Mexico, including New Orleans and Gulfport with room to grow in Port Arthur.

Sustainable rail

CPKC is also making efforts to cut emissions from its services. It has established a consolidated locomotive emissions reduction target based on the Science Based Target initiative for freight railroads below the 2°C global warming cap.

Along with rail freight provider CSX, CPKC is investing in a hydrogen locomotive programme and has completed two low-horsepower units that have entered service at its Calgary terminal for switching operations. The units have delivered seamless performance in combination with diesel-electric locomotives, according to Cunha.

“Both units have also been part of 48 mainline tests accumulating a combined 3,840 miles,” he says. “Our high horsepower locomotive has completed its first movement and is ramping up testing in the first quarter of 2024.”

The high horsepower unit includes a tender car delivering 1,200kg of additional hydrogen, which will enable a range comparable with diesel-electric locomotives in Alberta.

Part of Railpulse

Earlier this year CPKC joined the RailPulse Coalition, which is made up of railcar companies working together to develop the use of GPS and other telematics technologies to increase visibility, efficiency and safety on North America freight rail.

It is the third Class I railroad to join Railpulse, following Norfolk Southern and Union Pacific, and together the companies are working together to create a secure and standardised, vendor-neutral railcar telematics infrastructure in North American rail. Using the data from GPS and railcar-mounted sensors the coalition works to prioritise data standards and storage in the information in the cloud. CPKC says the initiative will enhance service levels, visibility, safety, sustainability and productivity.

“We are pleased to be a part of RailPulse and to contribute to accelerating adoption of railcar telemetry in North America,” says John Brooks, CPKC executive vice-president and chief marketing officer. “This collaboration aligns with our commitment to innovation and will play an important role in modernising our customer experience and provide benefits to the entire supply chain by advancing safety and improving operations.”

In a separate announcement, in April this year TrinityRail said it was upgrading railcar products and related services by integrating GPS technology. The company, which makes autoracks for finished vehicle rail shipments, among other railcar types, said the use of GPS technology would enhance its lease fleet with greater operational efficiency.

“By delivering more precise and timely data, the GPS-enhanced fleet facilitates smarter, faster, and more efficient fleet management decisions,” says the company. “This technological advancement not only revolutionises logistics management practices but also strengthens Trinity’s reputation as a comprehensive solutions provider dedicated to customer satisfaction.”

The company said that beyond the immediate benefits to customers, its investment in GPS technology exemplifies a broader trend among rail providers to create more reliable and predictable supply chains.

Railpulse Coalition members

- Bunge North America

- CPKC

- GATX

- Genesee & Wyoming

- Norfolk Southern

- Railroad Development

- The Greenbrier Companies

- TrinityRail

- Union Pacific

- Watco

In another move designed to optimise freight moves with technology, CSX has adopted Siemens Mobility’s Controlguide Core Dispatch System (CDS), which it says will help maximise network capacity, and improve safety and network security. Using the CDS alongside Siemens Mobility’s rail traffic network optimisation solution, TPS.live, on network rail operations, CSX will be gain continuous visibility of operations allowing for faster decision making and route optimisation.

CSX started working with Siemens Mobility back in 2022 on defining the features and functions of the CDS and have agreed a joint production operation rollout of the latest capabilities in 2027.

“Our partnership with Siemens Mobility allows us to unleash the full potential of cutting-edge software solutions that help transform our operations to improve safety, service, sustainability and efficiency,” says Carl Walker, vice-president of engineering at CSX. “Together, we are steering the future of rail transportation towards unparalleled efficiency and innovation.”

Freight corridor collaboration

Last year CPKC signed a collaborative agreement with CSX and rail freight provider Genesee & Wyoming to create a new direct CPKC-CSX interchange connection in Alabama.

CPKC and CSX are looking for approval from the United States Surface Transportation Board (STB) to acquire or operate portions of Meridian & Bigbee Railroad, which is owned by Genesee & Wyoming and operates in Mississippi and Alabama. The plan is establish a new freight corridor for shippers that connects Mexico, Texas and the US southeast.

CPKC would acquire and operate the segment of the Meridian & Bigbee line between Meridian and Myrtlewood, Alabama. At the same time CSX would operate the lines currently leased by MNBR east of Myrtlewood. As a result, CPKC and CSX say they would establish a direct CPKC-CSX interchange at or near Myrtlewood. In exchange, Genesee & Wyoming would acquire certain Canadian properties owned by CPKC and other rights.

Chicago to Monterrey

In another collaboration directly supporting carmakers and parts suppliers shipping freight across the US-Mexico border, BNSF Railway, Grupo México Transportes (GMXT) and JB Hunt Transport Services started an intermodal service in January that cuts shipment time between Chicago and Monterrey by one day.

The service runs between Monterrey, Silao-Bajio and Pantaco-Mexico City regions. According to the partnership, BNSF trains and JB Hunt trucks carrying intermodal containers interchange at Eagle Pass, Texas, to and from GMXT, which will operate the trains between the border crossing and Monterrey, Silao-Bajio and Pantaco-Mexico City six days a week. GMTX owns the majority stake in rail provider Ferromex. The service offers an alternative route over the El Paso, Texas border gateway.

BNSF operates approximately 52,300 km of track across 28 US states and three Canadian provinces, while JB Hunt owns and operates the largest intermodal fleet in North America, with more than 117,000 containers and nearly 7,000 trucks.

Carmakers are updating logistics processes and building more resilience into the supply chain for production volumes in Mexico. Greater efficiency in cross border automotive shipments will support Mexico’s claim of nearshoring opportunities and mitigate rising global logistics costs for carmakers both sides of the border.

In another move designed to improve intermodal services, Ferromex is working with road haulage company Jack Cooper at railhead handovers and together they are addressing the need for new locations to provide extra capacity for vehicle shipments.

Jack Cooper is also supplying emergency labour at the locations at which it provides backhaul services for third party logistics companies.

Cross-border disruption

In December 2023 US Customs and Border Protection (CBP) closed rail operations on the Eagle Pass and El Paso rail crossings between the US and Mexico because of increased numbers of migrants using the crossings to gain entry to the US. The closure lasted five days but the impact on freight movements was costly. According to the AAR around 450,000 rail shipments are made across the two gateways every year, including those for automotive parts and finished vehicles. The AAR estimated that $200m in goods, wages and transport costs could be lost each day.

“CBP has been working under exceptionally difficult circumstances, but these ill-advised closures were a blunt force tool that did nothing to bolster law enforcement capacity,” said AAR President and CEO Ian Jefferies when the connections were reopened. “As CBP continues their work to address this crisis, railroads strongly encourage the agency to abandon this tactic moving forward in favour of approaches that are capable of meaningfully enhancing its response capabilities.”

Ferromex also had to temporarily suspended operations in April this year because of migrant deaths and injuries caused by their attempts to cross the border on freight trains. The suspension affected 60 trains on northbound routes.

At Finished Vehicle Logistics North America 2024 there will be analysis and expert insight on the market drivers, disruptors, economic and geo-political factors shaping the forecasts for North American vehicle production and sales, including challenges in rail and inland service. The conference will take place 21-23 May at Waterfront Beach Resort, Huntington Beach, California.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet