The Teamsters Canada union, which represents 9,000 workers at Canada’s two biggest railroads, has threatened strike action that would disrupt North America’s supply chains from as early as May 22.

Update 17 May

Canadian Pacific Kansas City is resuming negotiations with Teamsters Canada Rail Conference union today in an effort to achieve a new collective agreement.

The union’s members voted in favour of strike, which “would disrupt supply chains on a scale Canada has luckily never experienced”, according to Paul Boucher, president, Teamsters Canada. The union is negotiating labour agreements at Canadian National Railway (CN) and Canadian Pacific Kansas City (CPKC) and has claimed that the freight carriers are attempting to scale back safety provisions for workers.

“After six months of negotiations with both companies, we are no closer to reaching a settlement than when we first began,” said Boucher. “Both companies are trying to strip our collective agreements of safety-critical rest provisions. We are at an impasse, with the companies failing to understand that the Teamsters will never compromise on safety or bargain with Canadian lives.”

The president added that “provoking a crisis” in the supply chain is not the goal and that the union would “very much like to avoid a work stoppage”. He said the union intends to go back to the bargaining table and work with mediators to reach a fair deal that does not compromise on safety or put profits over people.

Canada is a key automotive logistics region, providing pivotal connections across North America and Mexico. A more connected North American rail service answers the needs of an automotive industry that is nearshoring manufacturing and supply in response to international trade tensions, geopolitical disruption and the trade benefits regionally of the United States–Mexico–Canada Agreement (USMCA).

Oliver Bilstein, vice-president of logistics for BMW Manufacturing, previously said that the carmaker’s Spartanburg, South Carolina plant has added an additional railhead besides the one that connects directly to its plant, trucking vehicles a few hours from Spartanburg to another rail location to move vehicles to Canada.

Similarly, Canada is an important hub in the battery supply chain as it offers the benefit of localised supply of raw materials and wide access to clean electricity, prompting the likes of VW Group’s lithium battery division, PowerCo to plan a gigafactory in the province of Ontario. Having rail access cut off from this hub would be detrimental to the wider North American supply chain.

Members of CN voted 97.6% to authorise a strike, with a 93.3% turnout, while CPKC members voted 99% in favour with a 91.7% turnout.

Read more: How Class 1 rail providers are responding to demands on capacity

CN said that it suggested a “simplified, alternative path to achieve a deal” prior to May 22, which was “designed to protect the Canadian supply chain, the North American economy and ensure employees get a fair deal,” but said the union “made very few concessions”. It added: “Regrettably, CN maintains a cautious outlook regarding possibility of finalising a deal before a labour disruption that would affect the Canadian supply chain, the North American economy and our employees.”

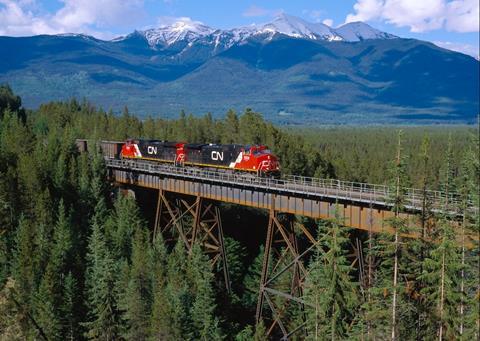

CN operates 20,000 miles (32,200km) of tracks between the east and west coasts of Canada with southern US, and carries 300m tons of cargo per year.

CPKC’s network runs for the same distance between markets in Canada, the US and Mexico and employs around 20,000 people. Canadian Pacific and Kansas City Southern completed a merger last April, when CP bough KCS for $31 billion in December 2021. The merger resulted in the first integrated single-line North American Class 1 rail network.

At Finished Vehicle Logistics North America 2024 there will be analysis and expert insight on the market drivers, disruptors, economic and geo-political factors shaping the forecasts for North American vehicle production and sales, including challenges in rail and inland service. The conference will take place 21-23 May at Waterfront Beach Resort, Huntington Beach, California.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet