PARTNER CONTENT

This content was produced by Automotive Logistics in partnership with DP World

DP World is scaling up its investment in efficient ro-ro operations and advanced technologies to meet growing global vehicle demand and deliver connected, sustainable services, suitable for OEM customers.

DP World is reaching beyond its well-established role as global leader in port operations to become a supplier of end-to-end logistics services for the automotive sector. Along with inbound and service parts logistics, the company is expanding its services in finished vehicle logistics and its ro-ro operations have grown significantly in recent years, from 16 to 22 locations around the world.

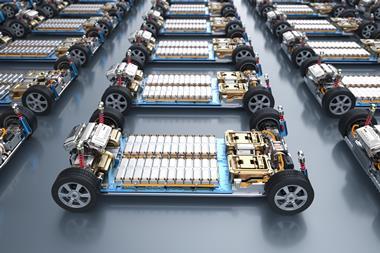

“The rise of electric vehicles (EVs), nearshoring and broader geopolitical realignment have aligned with our investments, pushing our ro-ro operations to a new level of scale and efficiency,” says Tiemen Meester, group chief operating officer for Ports & Terminals at the company.

DP World’s priorities when it comes to ro-ro operations include minimising vehicle dwell time to keep volumes moving through its ports efficiently, reducing the time vehicles spend sitting idle and helping customers get products to market faster.

“We have established integrated port-side logistics hubs featuring state-of-the-art storage facilities, enabling importers to efficiently manage seasonal demand fluctuations,” says Meester.

Damage prevention is a critical operational metric for DP World’s ro-ro operations. With decades of experience, it has honed its expertise to deliver best-in-class damage control solutions for the automotive logistics industry

Speed to market does not come at the cost of quality and DP World carries out robust inspections and specialist vehicle transfer processes. Transparency is crucial and the company uses real-time monitoring systems to track vehicle movements across its terminals, which gives it full visibility, helps maintain smooth flow throughout the facilities, and allows early detection and resolution of any bottlenecks or issues before they impact operations.

“Cargoes, our suite of digital solutions, makes our customers’ supply chains smarter, offering them real-time updates on vehicle status, location and movements. This makes it easier for OEMs and logistics providers to manage their supply chains proactively,” says Meester.

The company has designed its port and terminal operations to adjust quickly to volume peaks and troughs, ensuring it can scale capacity up or down as needed to meet the needs of OEM and carrier partners.

Gateways for growth across EMEA

DP World is expanding ro-ro operations globally on these core principles, including in Europe, the Middle East and Africa. For example, this year DP World opened a 25-hectare facility in the Belgian port of Zeebrugge with storage for 7,000 vehicles which it said will enhance efficiency, connectivity and flexibility for Europe’s automotive industry.

In the past year the logistics provider has also invested €130m ($146m) in new facilities in the Romanian port of Constanta and at Auid to help meet rising demand for nearshoring and automotive growth in markets including Romania, Hungary and Turkey. In Constanta, DP World has opened a ro-ro terminal with annual capacity for 80,000 finished vehicles alongside a 5-hectare project cargo terminal. This year it will also open a €50m ($55.9m) multimodal platform. In Auid, a new 8-hectare intermodal hub strengthens inland rail and road connectivity.

“Our Constanta terminal in Romania is also being developed with a strong focus on sustainable vehicle flows and carbon-neutral operations,” says Meester.

Rail connectivity is central to DP World’s strategy for sustainable vehicle flows. In Romania, cargo arriving at Constanta port is moved directly by rail to the new intermodal terminal in Aiud, reducing road dependency, cutting emissions and accelerating delivery times. This approach is mirrored across DP World’s global network, including operations in Sabah, Eurofos and Evyap, where integrated logistics and multimodal transport solutions are enhancing supply chain efficiency and environmental performance.

In Africa, DP World has added a terminal in the Tanzanian port of Dar Es Salaam. “The terminal has almost 100% share of Tanzania’s automotive import market so our operations are vital,” says Meester. “We have increased efficiency, moving from 15,000 CEU a month to 27,000, and we continue to invest in the local workforce, providing continuous training to ensure world class standards in finished vehicle handling.”

Middle East momentum

In the Middle East, DP World has seen strong growth at its Jebel Ali vehicle terminal in the United Arab Emirates (UAE). The company moved close to 1m vehicles through Jebel Ali in 2024. That growth has been largely driven by the surge in Chinese OEM exports, with Dubai now acting as a major redistribution hub for vehicles into the Middle East, Africa and beyond.

“At Jebel Ali, our ro-ro berths can handle up to 1m car equivalent unites (CEUs) while storing up to 27,000 CEUs within our quayside yards, including a multi-storey facility, the largest in the region,” says Meester. He adds that the strategic location of Jebel Ali, combined with its integrated multimodal connections, linking sea, road and rail, enables DP World to move vehicles more efficiently and reduce dwell times. That is supported by enhancements in digital yard management, which help optimise throughput and minimise bottlenecks during peak periods. DP World is also able to facilitate customs clearance directly at the port, speeding up time-to-market.

With the growth in exports from China, increasingly of battery electric vehicles (BEVs) and hybrids, DP World is providing specialised battery handling services at Jebel Ali, ensuring safe storage, movement and management of high-voltage vehicles. Value-added terminal services also include pre-delivery inspection (PDI) and vehicle quality inspections on-site, allowing OEMs to prepare vehicles for market without the need for additional external handling, saving time and reducing risk.

“We have also implemented damage prevention protocols, including advanced loading and unloading techniques, real-time condition monitoring, and specialist training for vehicle handlers to ensure that every unit moves through the terminal safely and efficiently,” says Meester.

Investing in sustainable logistics

As the demand for sustainable operations accelerates across the value chain, meeting evolving operational and safety requirements remains a strategic priority.

“We’re installing charging infrastructure to support the needs of manufacturers, logistics providers and end customers who may require vehicles to be charged prior to onward transport,” says Meester. “We’ve implemented comprehensive safety protocols to ensure smooth operations, covering everything from fire prevention and thermal management to emergency response.”

DP World is also upskilling its teams to ensure they are fully prepared to manage new transport technologies with the highest standards of care and efficiency. That aligns with the company’s broader welfare priorities for staff.

We’re installing charging infrastructure to support the needs of manufacturers, logistics providers and end customers who may require vehicles to be charged prior to onward transport – Tiemen Meester, DP World

“Key to so many of our operations is proper people management and training,” says Meester. “Making sure our ro-ro drivers have adequate breaks and rest time, while also maintaining training, drastically reduces damage risk and keeps our operations safe.”

Electric vehicles are being used to help decarbonise port operations and move cars within the terminals as well as for personnel transportation.

“In Romania we have replaced diesel cars used to move personnel inside the terminal with electric cars, reducing CO2 emissions by 82% compared to previous vehicles,” says Meester.

At London Gateway, DP World’s first all-electric berth is serviced by a fleet of electric vehicles and equipment, including quay cranes, straddle carriers, and automated stacking cranes. At Jebel Ali, DP World, in partnership with Einride, is deploying a fleet of connected, heavy-duty electric trucks to electrify inter-terminal container flows.

DP World is also installing cold ironing systems at select ports, which allows vessels to plug into onshore electricity while at berth rather than running engines to reduce emissions.

Ports of the future built on data, driven by AI

These cleaner technologies are part of DP World’s investment in the latest tools for port management. That includes applying digital twin technology in some of its key terminals allowing it to create a virtual model of port operations, simulate different traffic and loading scenarios ahead of time, and fine-tune our processes based on real-world data.

“We are employing digital tools in our operations such as Batangas and Chile which allow us to check cargo flows in real time, generating damage reports and spotting congestion as it happens,” says Meester. “This real time data not only allows us maximise efficiency but also gives us customers a more transparent view of their supply chains.”

The company is also rolling out yard automation across key terminals using AI-driven vehicle movement optimisation to dynamically manage the placement and movement of vehicles, reducing congestion and idle times while maximising throughput.

Resilient infrastructure in an unpredictable world

Looking ahead, Meester says DP World is preparing for an anticipated increase in global vehicle production and the growing volume of BEV exports, particularly from markets such as China and eastern Europe. That growth in traffic is putting pressure on available ro-ro vessels and DP World is ready to manage it by maintaining flexible scheduling and collaborating closely with shipping lines and customers to optimise vessel calls and terminal operations.

The car carrier segment has become a strategic focus for DP World, recognising the global scope and centralised management of major car carrier networks. Developing headquarters-level relationships allows DP World to demonstrate to customers their global capacity.

At the same time, it continues to manage existing disruption to traditional routes in volatile hotspots such as the Red Sea and east Mediterranean.

“We have strategically placed ports and terminals which are able to accommodate redirected volumes,” Meester points out. “For instance, Jebel Ali has established itself as a reliable and secure transhipment hub for the region and our Limassol terminal has also provided a new gateway to the eastern Mediterranean.”

Meester points out that geopolitical uncertainty is driving a longer-term shift towards nearshoring in regions such as central and eastern Europe, and investments such as the new multimodal hubs in Romania are designed to give automotive customers more resilient regional supply chain options.

Read more about DP World’s ports and terminal operations here

No comments yet