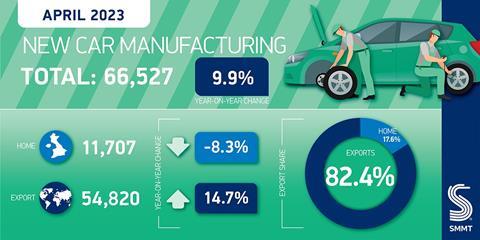

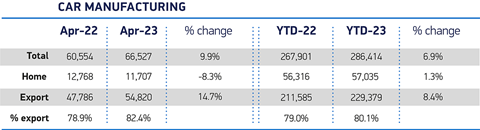

The Society of Motor Manufacturers and Traders (SMMT) in the UK has reported an increase in vehicle production and exports for April this year, with more than 82% of the 66,527 vehicles bound for overseas markets.

It also called for a review of the UK-EU Trade and Cooperation Agreement governing local content for electric vehicles (EVs) and batteries, which will get tougher from 1 January 2024. Stellantis and Ford have also called for a delay to the imposition of new rules of origin legislation governing battery supply.

Production was up 9.9% in April, against the same month in 2022, and it is the third consecutive month of production growth for UK-based manufacturers. The result indicates an easing of the disruption to the inbound supply chain.

Production is being driven by exports, which rose 14.7% to 54,820, and the SMMT reported that this was also the third month in a row that exports have risen in double-digits.

The EU accounted for the majority of those exports (58.4%), equivalent to just over 32,000 vehicles, a rise of more than 12%. The US, China and Australia were the next three biggest markets for UK-made vehicles.

The SMMT also highlighted the increase in the numbers of hybrid electric (HEV), plug-in hybrid (Phev) and battery EVs, with combined volumes up 56.2% in April, representing well over a third of all production (37.7%).

Tariffs on EV trade

Securing the continued production and export of these battery EVs is crucial to the future of UK vehicle manufacturing. The SMMT said the toughening of trade rules under the UK-EU Trade and Cooperation Agreement from January next year poses a challenge to manufacturers in the UK and mainland Europe because of what the SMMT describes at punitive tariffs which will be applied the movement of EVs and batteries.

Under the rules of origin, at least 40% of the value of any EV should originate from the EU or UK to avoid a requirement to pay import duties, although this number will increase to 45% from 1 January 2024.

“UK car production is starting to motor again, good news for the sector and the many thousands of jobs and livelihoods it sustains,” said SMMT chief executive, Mike Hawes. “These figures also show how exports, particularly to Europe, continue to be the foundation of British automotive manufacturing, so we must do all we can to safeguard the competitiveness of these trading relationships. Most immediately, this means finding a solution to the rules of origin challenge faced by manufacturers on both sides of the Channel, else we risk the application of tariffs – and therefore unnecessary cost – on the very vehicles we are trying to encourage consumers to purchase.”

As part of its submission to a recent parliamentary business and trade committee inquiry into EV production in the UK, carmaker Stellantis warned it would be no longer able to meet trade rules on parts sourcing once the rule on 45% content was applied. The carmaker called for the deadline to be extended to 2027 to avoid 10% tariffs.

“The current Trade and Cooperation Agreement requires European players to have originating CAM [cathode active materials] and high European content in batteries, necessitating manufacturers to produce batteries either in the UK or Europe,” Stellantis told the committee. “If we do not produce in the UK or in Europe, we will be faced with 10% import duties, which will make domestic production uncompetitive against Asian players.

The carmaker also pointed to the impact on battery logistics costs, which along with tariffs, would make continued production in the UK uncompetitive.

“If we source batteries from mainland Europe and China, as currently planned, our UK Stellantis plants will also be at a competitive disadvantage due to the higher logistics costs that we will face to transport the batteries from mainland Europe to the UK,” Stellantis told the committee.

The carmaker said that was a threat to its export business and its UK manufacturing operations. It has already committed £100m ($137m) in Vauxhall’s Ellesmere Port plant for the exclusive production of electric vehicles.

“To reinforce the sustainability of our manufacturing plants in the UK, the UK must consider its trading arrangements with Europe,” said the vehicle maker.

Ford has also now added its call to delay the imposition of the rules of origin to 2027.

“Ford is calling for current trade requirements to be extended to 2027, to allow time for the battery supply chain to develop in Europe and to meet EV demand,” Tim Slatter, chair, Ford Britain, said in a statement. “Tariffs will hit both UK- and EU-based manufacturers, so it is vital that the UK and EU come to the table to agree a solution.”

No comments yet