Freight forwarder CFR Rinkens has made its first westbound rail shipment of containerised vehicles between China and Germany. One hundred Fengon Glory SUVs made by China’s Dongfeng Motor were shipped in 36 containers in cooperation with Chinese rail operator Yuxinou Logistics. The train left Chongqing in mid-April, just as the region was relaxing restrictions put in place to control Covid-19, and arrived in the northern automotive logistics hub of Bremerhaven on May 6, where CFR has its own processing facility.

“We are especially proud of this successful project launch during very challenging times both in China and Europe,” said Alan So, sales director at CFR Rinkens Automotive Logistics, CFR’s Chinese subsidiary.

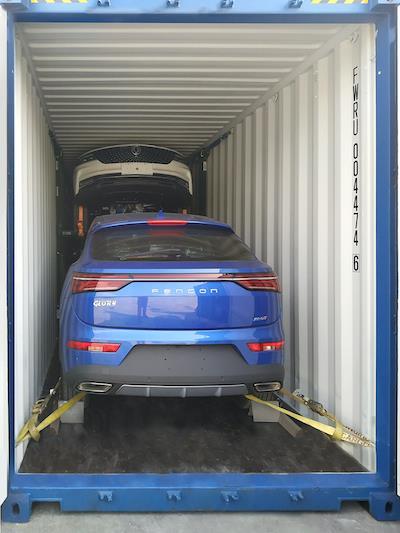

Dongfeng plans to ship one block train per month with three SUVs per 40-foot high cube container and CFR is using Trans-Rak International’s R-Rak racking system to safely load the vehicles into the containers.

Total transit time from Chongqing to Bremerhaven is 18 days as the train passes through western China, Kazakhstan, Russia, Belarus, Poland and northern Germany. That compares to an ocean shipment that can take anything up to 50 days door-to-door.

CFR is already loading vehicles into containers for rail shipment from Bremerhaven to locations in China.

“Bremerhaven and Chongqing are positioning themselves as primary hubs for containerised vehicle shipments on the Silk Road, which is why CFR set up operations in both cities,” said So. “And balancing traffic both ways is key. We get closer to that goal by launching this westbound train.”

Uwe Jablonski, CEO of Indimo Automotive, the official importer of Dongfeng Sokon (DFSK) and other Chinese brands in Germany pointed out that while freight cost for Silk Road rail shipments was still about double the cost of the traditional ro-ro mode, the faster delivery had a positive impact on cash flow.

“We expect westbound rail costs to come down as more goods move both ways on the Silk Road,” Jablonski added.

Planning through a pandemic

According to CFR, the fact that the planning and implementation phase of the new project was taking place as the coronavirus pandemic spread from east to west meant the company faced severe travel limitations and quarantines in China while coordinating meetings, equipment repositioning, and setting up the container loading operation near the Chongqing rail terminal.

CFR has remained operational worldwide throughout the pandemic crisis but has had to adjust processes across its warehouses and offices in China, Europe and the US.

“Most office staff already work from home, and we are enforcing strict rules around social distancing, the use of personal protective equipment, spaced out shifts in order to reduce the number of people present at any time, and constant sanitising of all facilities,” explained Christoph Seitz, CEO of CFR Rinkens. “We need to ensure that each of our customers’ supply chains continues to move.”

Silk Road traffic

Rail services between China and Europe, along the Silk Road Economic Belt, having been growing since 2013 when China’s president Xi Jinping announced the comprehensive international trade and infrastructure plan known as the Belt and Road Initiative. Containerised finished vehicle shipments are gaining popularity among OEMs because of considerably faster transit times and regular, weekly departures compared to ocean alternatives. A number of carmakers are now using rail to move vehicles in both directions. For example, since 2017 Volvo has been working with Changjiu Logistics to move volumes of its S90 sedan by rail between Daqing in China and Zeebrugge in Belgium. Last week it announced an additional cross-border option for that route.

Audi, BMW, Daimler and Volkswagen have all announced similar services in recent years moving vehicles in containers from west to east.

“We are confident that containerisation of finished vehicles will gain even more traction as factories reopen across the globe,” said Seitz. “The outbound logistics chain everywhere, from factory outgate to dealer delivery, is facing severe interruptions due to vehicle inventory imbalances, reduction and realignment of carrier capacity, and other constraints. Containers provide the flexibility that traditional transport modes like ro-ro and multilevel railcars cannot.”

1 Reader's comment